Get Involved

Media

About

Contact

Investing catalytic capital to resolve climate finance bottlenecks in emerging economies

Get Involved

Media

About

Contact

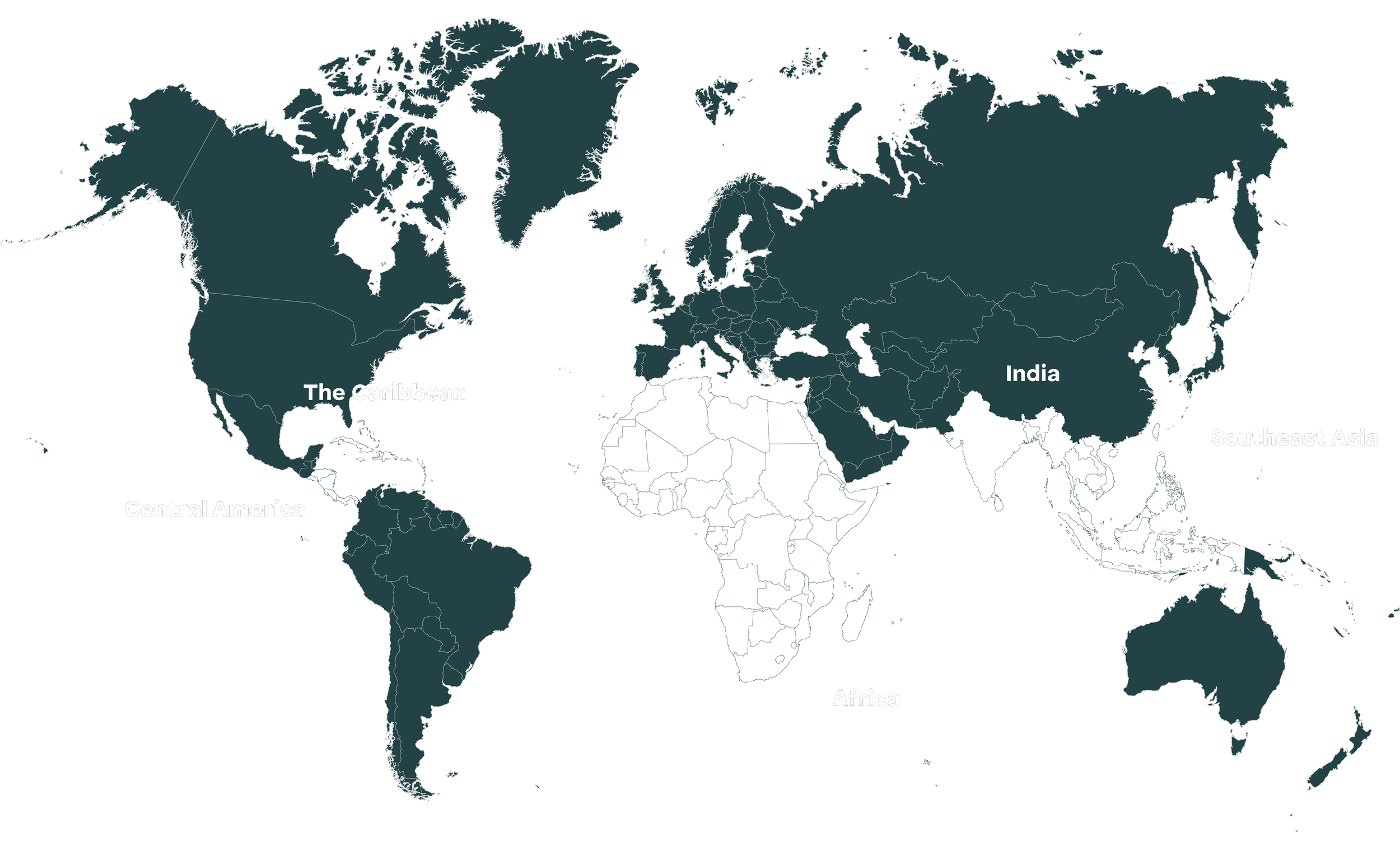

Allied Climate Partners (ACP) is a philanthropic investment organization with a mission to address climate finance bottlenecks in emerging economies to create significant environmental, economic, and social impact. ACP’s initial focus regions are Southeast Asia, Africa, India, and the Caribbean & Central America.

ACP is backed by leading philanthropies working at the nexus of economic development, climate action, innovation, and finance in emerging economies.

Who we are

ACP partners with regional investment managers in emerging economies. We help to establish and anchor funds by providing catalytic junior equity investments and value-added support.

What we do

ACP’s funds are expected to create positive impacts on vulnerable & at-risk communities – including improving access to clean and resilient infrastructure (e.g., energy, transport) and strengthening resilience against climate risks.

The initial proof-of-concept for ACP is the Southeast Asia Clean Energy Facility (SEACEF), managed by Clime Capital.

Each fund targets a key bottleneck impeding the flow of capital to climate-related sectors and aims to increase the number of bankable projects and asset-oriented businesses.

“The shortage of bankable projects is a critical, persistent challenge in emerging economies. ACP’s leadership in providing affordable innovative financing to early-stage climate projects and companies addresses the urgent need in the transition to net zero, acting as a pioneering market making catalyst for underserved sectors.”

— Damilola Ogunbiyi, UN Secretary General's Special Representative

and CEO for Sustainable Energy for All (SEforALL)

Latest News

IDB Invest Cultivates Caribbean Fund Managers to Mobilize Private Capital

IDB Invest | 12 December 2025

Clean energy equity investment in EMDEs must increase fourfold by 2035 for net zero

Climate Policy Initiative (CPI) | 14 November 2025

Green Investments Partnership, a Blended Finance Fund under Singapore’s FAST-P initiative, Achieves First Close with US$510 Million in Committed Capital

Monetary Authority of Singapore | 8 January 2025

ACP’s Challenge:

Increasing the number of bankable climate-related projects and businesses in emerging economies

ACP’s Investment Focus

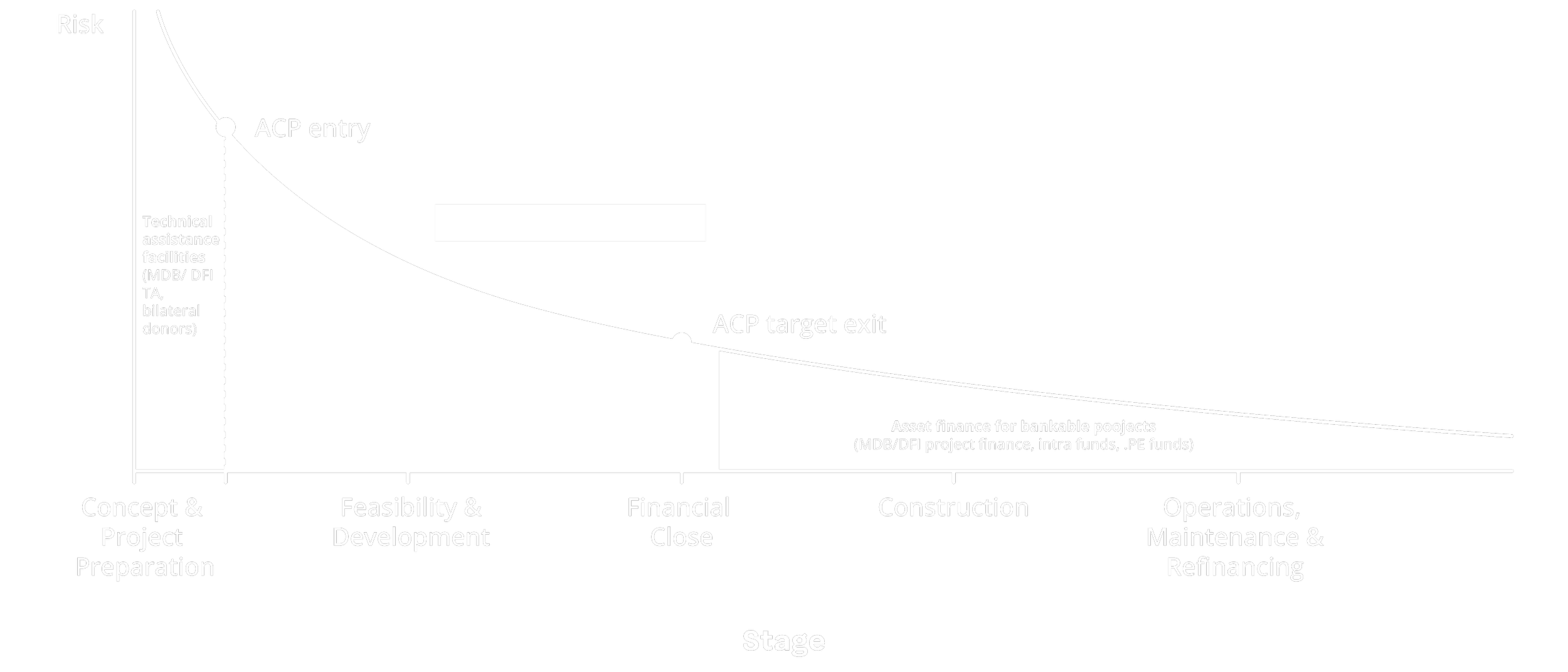

Infrastructure projects face their highest risks at the earliest stages, particularly in emerging economies. As a result, risk-oriented capital is often in short supply, and it can be challenging for entrepreneurs and developers to access the early-stage capital and assistance they need to develop climate-related projects and businesses to the point of bankability and financial close.

How ACP addresses the challenge

ACP’s capital seeks to fill critical early-stage gaps to address climate-related finance bottlenecks in EMDEs.

By originating and anchoring local investment managers with catalytic, junior capital, ACP will:

Focus on climate projects and companies at early stages of development when risk-oriented capital can have a significant impact.

1

Systematically de-risk investments by providing tranched, milestone-based disbursements and hands-on management support (e.g., strategy, hiring)

2

Seek to exit early, crowd in third-party investors, and recycle proceeds to create more bankable projects

3

Ensure investments promote jobs, green industrialization, inclusive growth, and shared prosperity in vulnerable and at-risk communities

4

In addition to funds focused on providing equity at the critical early stages of project development, ACP is now actively evaluating additional climate finance bottlenecks where it could focus on establishing funds (e.g., other project stages, specific sectoral funds, or new regions).

How ACP supports selected regional managers

ACP provides hands-on, value-added support by:

Working closely with regional investment managers to support their strategies, fundraising, and networks

Anchoring selected investment managers with first-loss, junior equity. This enables them to raise senior equity and create funds of sufficient scale focused on early-stage, climate-related projects and asset-oriented businesses

Investing in strategic partnerships in the ecosystem to improve the investment landscape for regional funds and achieve climate impact

Initial Focus Regions

Our Partners

Information:

About Us

Media

Contact

This website does not constitute an offer to sell or the solicitation of any offer to buy any securities or service. This website contains forward-looking statements which may or may not be realized and are contingent on uncertain events.

© 2026 - Allied Climate Partners, Inc.